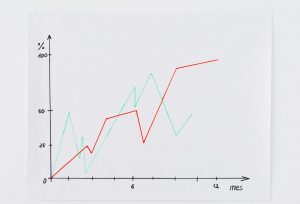

2022 was pretty terrible for U.S. initial public offerings (IPOs), which according to data compiled by Bloomberg raised just more than $18 billion last year. That’s a staggering decline of more than 95% from 2021, in which a record $275 billion was raised.

That massive 2021 number was largely propelled by a boom in blank-check companies that have since all but disappeared.

While there is hope that the market will rebound somewhat in 2023, companies thinking of going the IPO route are still dealing with an unpredictable market, especially in terms of high interest rates and potential further rate hikes by the Federal Reserve.

“It will probably take some of the bigger named companies that have stronger financials and profitability to return to the market as the first movers, and hopefully that will open up the market and others will follow,” said Marcel Fausten, a New York capital markets partner at Davis Polk & Wardwell.

Just two of the top 10 firms in 2021 in terms of advising issuers or underwriters experienced less than a 90% decline in deal value in 2022. Weil Gotshal & Manges saw a drop of 88% in issuer-side work, while Ellenoff Grossman saw an 84% drop in its underwriter-side practice.

In terms of number of deals, only Ellenoff Grossman & Schole and Loeb & Loeb advised on more than 10 underwriter-side IPOs last year, while the only two firms to advise on more than 10 issuer-side offerings were Maples & Calder and Loeb & Loeb.

In 2022, there was an average 95% decline among the top 10 firms in IPO value on both the issuer and underwriter side.

Fausten of Davis Polk is cautiously optimistic that the IPO market could gain some traction in the second half of 2023, even while private companies continue to adjust to significant declines in public market valuations.

“A lot of private companies have valuation expectations still grounded in what people were seeing in ‘21 and have not necessarily readjusted,” Fausten said. “There’s a process of those valuations being brought down to be more in-line to their public peers.”